The banking industry is at a pivotal moment. With the integration of artificial intelligence in banking and Big Data Analytics in banking, financial institutions are moving beyond traditional services. These technologies are not just enhancing efficiency—they’re reshaping how banks predict, analyze, and respond to customer needs, fraud risks, and market trends.

The AI in the banking system is no longer limited to automation. Today, it has transcended time and enables hyper-personalized financial services, real-time fraud detection, and predictive analytics on risk management.

In the same way, Big Data in banking heralded yet another major decision-making era by prospectively provisioning banks with the power to anticipate market change and customer behavior.

But with progress comes risks. AI and big data implementation is promising efficiency and innovation but raise a serious concern about data security, responsible use of AI, and possible job losses.

Will AI turn around banking as we know it today, or will it be more dangerous than useful? Let’s explore here.

The Emergence Of AI And Big Data In Banking

Historically reliant on numbers, banking has been altered; AI and Big Data Analytics in the banking sector gave way to predictions rather than reactively based decision-making.

The principle is simple: knowing your customers leads to better recommendations. This idea, once central to traditional banking, is now even more critical in the digital era. With AI in banking, institutions can analyze vast datasets to personalize financial advice like never before.

For instance, big data analytics in banking enables algorithms to assist advisors in selecting the best funds, bonds, or stocks for customers. Instead of relying solely on past financial records, AI-driven insights help banks predict customer behavior and offer tailored investment opportunities.

This transformation is no longer optional; it’s a necessity. With the market for big data analytics in banking projected to reach $745.16 billion by 2030, its influence will only grow.

What Is AI In Banking?

AI is redefining banking, shifting from routine automation to strategic decision-making. From fraud detection to personalized banking, the use of AI in the banking industry is reshaping how financial institutions operate.

Banks no longer just process transactions—they predict needs, mitigate risks, and enhance customer experiences.

According to a banking report from McKinsey, generative AI productivity gains in the banking industry are expected to reach 5% and could reduce global costs by up to $300 billion! AI-driven financial advisors analyze spending patterns and recommend personalized solutions for saving or investing money.

One of the prominent examples of artificial intelligence in the banking sector is companies like JPMorgan Chase’s COiN, which analyzes legal documents in seconds. Similarly, Bank of America’s AI assistant, Erica, has handled over 2 billion customer interactions since launch, helping 42 million clients. These innovations prove AI isn’t just improving banking—it’s revolutionizing it.

The Importance Of Big Data Analytics In Banking

Data is now substantiating everything in modern banking from fraud detection to personalized customer experience. This entails using banking analytics to predict spending behavior, evaluate creditworthiness, and offer customized financial products.

For example, Citigroup’s data modeling demands that any anomalous transaction be analyzed during real-time processing so that fraud can be detected and prevented before the crime occurs.

Banks use big data implementation to assess credit risks, ensure compliance, and mitigate financial threats. As quoted from Antra’s Chief Business Analyst-

“Big data analytics isn’t just about numbers—it’s about unlocking deeper customer insights, mitigating risks, and driving smarter financial decisions.”

With the advent of Big Data, the implementation raises concerns about security and ethics. And it’s led to a serious question- Will financial institutions be able to balance innovation with privacy?

How AI And Big Data Will Enhance Customer Experience?

Banking today (in the post-COVID era) is about much more than transactions; it’s all about experiences. Customers expect instant support, tailored financial advice, and real-time fraud protection.

AI in banking meets these demands. AI-powered chatbots offer 24/7 customer support and machine learning algorithms can effectively analyze customer information to personalize services & identify real-time fraud detection.

With your historical and real-time data being fed into systems at all times, your AI-equipped processes can easily personalize and tailor your financial services to be more lucrative to customers.

However, with all that automation, can banks still offer a human touch? As AI reshapes customer service, the fine balance between digital and human will be paramount.

Key Statistics:

(Source: McKinsey & Company) |

Will AI Replace Investment Bankers?

While AI is greatly transforming investment banking, the complete replacement of human investment bankers seems impossible. Some job losses will be experienced in investment banking, but new jobs will also be created in data analytics, research, compliance, and financial analysis.

As per the market prediction, instead of replacing bankers, AI will serve as a powerful tool to enhance decision-making. However, the key factors driving these concerns are:

Increased Efficiency, Speed, And Lack of Errors

AI, with its ability to compute complex financial models instantaneously, will remove human error and improve investment decision efficiency.

Real-Time Data Analysis on Large Datasets

AI-enhanced big data analytics processes in banking enhance the capability of analyzing gigantic volumes of financial data in real time, thus deriving insights with greater depth than human analysts.

Portfolio Management

Machine learning optimizes portfolios by forecasting market trends for dynamic investment adjustments.

Risk Management

AI finds patterns of financial risk faster than conventional methods adopted, empowering banks in data-led decision-making.

24/7 Services

AI provides immediate recommendations and market insight, unlike human analysts, 24/7.

The downside? Investment banking isn’t just about numbers—it’s about relationships, trust, and negotiation. Workflows may be optimized by AI. But it’s only human insight that will never be replaceable. Rather than replacing investment banking professionals, AI will augment their capabilities, improving productivity while still ensuring a human presence.

Big Data in Banking: Key Benefits And Main Challenges

The big data implementation in banking has revolutionized financial operations, improving decision-making, security, and customer engagement. However, its adoption comes with both opportunities and roadblocks. Let’s explore here:

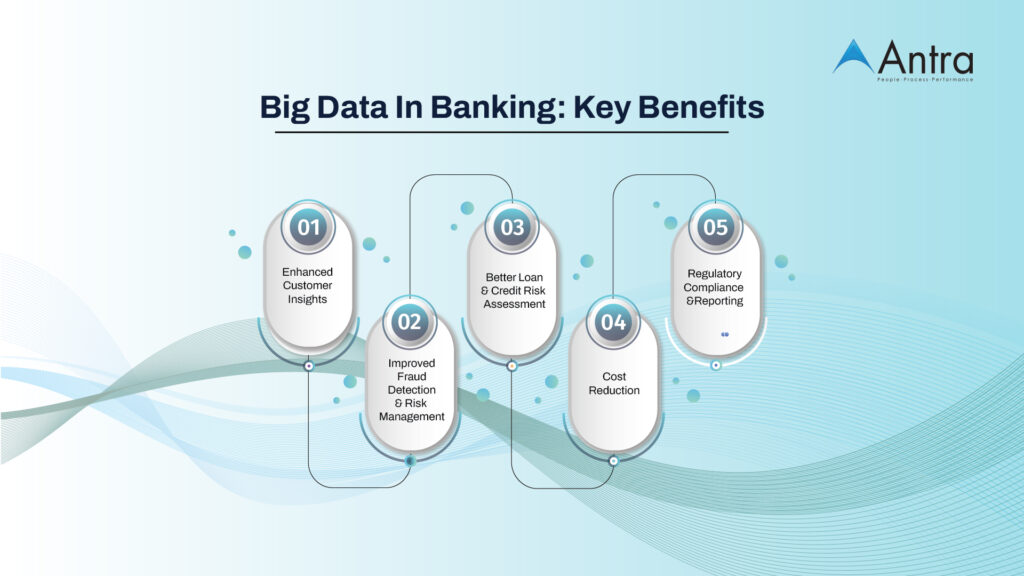

Key Benefits Of Big Data In Banking

- 24/7 Enhanced Customer Insights

Big Data analytics provide insight into customers’ behavior that banks can use to design products that suit their individual needs and undertake targeted marketing activities. - Improved Fraud Detection & Risk Management

Real-time banking analytics allow instant identification of fraudulent transactions, decreasing the prevalence of financial crime and viable risk management. - Better Loan And Credit Risk Assessment

AI-driven models analyze vast datasets to evaluate creditworthiness, reducing defaults and improving lending accuracy. - Operational Efficiency & Cost Reduction

Big data employed in banking enhances operational efficiency through automation that reduces manual efforts and costs. - Regulatory Compliance And Reporting

Big data analytic examples in banking show banks using AI-driven models for compliance to stay in sync with changing regulations.

Top Challenges Of Big Data in Banking

- Data Privacy And Security

Banks deal with a large amount of sensitive financial information; making them the first targets of cybercriminals and breaches of data. - Integration With Legacy Systems

Banks often face a severe challenge when combining big data implementation with the old IT infrastructure in their banks. - Regulatory And Ethical Issues

AI Banking needs to comply with stringent regulations and thus generates concerns about transparency and fairness. - Implementation Costs

Implementing advanced big data analytics in banks requires huge investments in technology and talent. - Data Quality And Accuracy

Inaccurate or incomplete datasets tend to create faulty AI-driven financial decisions.

How AI Is Helping Banks Support Sustainability Transformation

The ability to process vast amounts of data quickly makes AI in banking a game-changer for sustainability efforts. With new regulatory frameworks, banks must accurately assess and report sustainable transactions.

AI-driven big data analytics in banking enables autoclassification, where machine learning models analyze corporate loans and investments to determine their environmental impact. This not only ensures compliance but also streamlines sustainability.

" AI-driven automation is revolutionizing banking sustainability—accelerating green finance classification while reducing manual workloads. The future of banking is not just digital, but sustainable. "

— [Director Of Innovation- Antra]

As banks increasingly adopt big data implementation, AI will play a crucial role in climate-conscious lending, ESG investment analysis, and carbon footprint reduction, ensuring a more sustainable financial ecosystem.

Wrapping Up

| “The real competitive advantage in any business is one word only, which is ‘people.’” — Kamil Toume |

The future of banking, supported by AI, promises an era in which technology breakthroughs coexist alongside customer-centered methods. As AI evolves, the use of this technology becomes crucial, not just for banks’ adoption but also in a morally responsible way. Those who strike the right balance will not only lead but will reimagine banking’s future.

Are you ready to embrace this transformative shift? Contact Antra today to learn how we can help you navigate the future.